By Joey Deaton – Syracuse University ’21

Abstract

Each year, dozens of National Basketball Association (NBA)-hopeful collegiate and international basketball players enter the NBA draft. In this paper, we will be analyzing the decision-making process of whether to declare and also whether a player should consider making an attempt at playing overseas. We will be using the topic of reservation wage from labor economics in order to analyze the timely preferences of athletes deciding between staying in college versus chasing the dream of professional basketball right away, whether that be overseas or domestically. Results show that athletes that value their current consumption at least as much as their leisure, represented by their years playing collegiately, should usually have the ability to attain a wage on the international basketball market that is preferable to their reservation wage. In 2020 and 2021, there might also be a shift in the preferences of elite prospects, shown by a greater number of high school athletes deciding to commit to professional basketball instead of college than in years past.

Introduction

To declare or not to declare? That is a question posing dozens of collegiate basketball players every year. After seeing their college seasons come to a close, the question of whether or not to turn pro is a decision hundreds of players will entertain every spring.

For some, it’s the question of how much they want to continue to enjoy their collegiate careers, continuing to hone their craft before declaring when they have the best opportunity for a successful professional career. For others, the opportunity to begin making money for themselves is far more attractive than another year of penniless college gameplay.

In this paper, we will discuss the consequences of making the decision to declare along with analysis of the professional basketball labor market both domestic and abroad. We will look to assist in the NBA-hopeful player’s decision-making process of where to most effectively take their talents based on key factors such as their preferences between collegiate growth and immediate income, expected NBA wage return, and years of college eligibility.

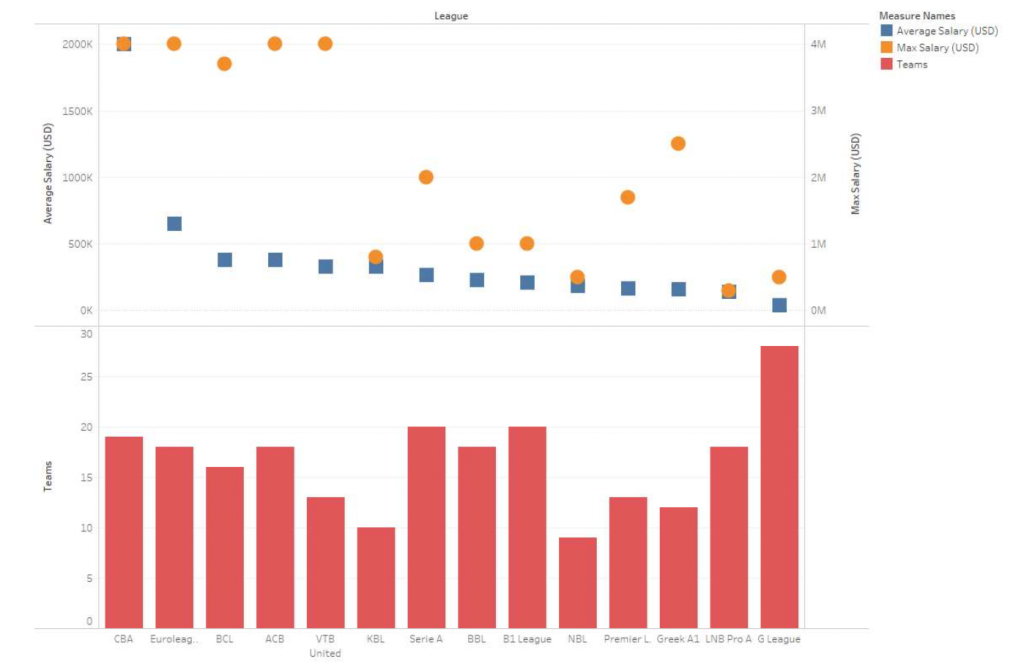

International Market Data

The above chart represents some of the most well-established professional basketball leagues around the world. The top portion of the visualization shows the top-paying leagues while the lower visual shows the market size of each of the leagues in terms of number of teams in each league.

Theoretical Analysis

A key object used in labor economics to determine a worker’s participation in a market is the worker’s reservation wage. The reservation wage is defined as the lowest wage that is large enough to induce a worker to take a job in the labor market. It comes from examining how a given worker will select consumption(c) and leisure(l) based off his utility function(U) and constrained off the hours(H) he has available for work or leisure, the wage rate provided by the market(w), and his non-labor-related income that he has to fall back on(Y).

Now how can we apply this fundamental idea from labor economics to this specific labor market decision scenario? Well we can consider that instead of having hours in the day to consider work or leisure, prospective NBA talents have a period of four years which they can spend in college or play overseas before entering into the NBA Draft. So, if we consider the problem of

max 𝑈(𝑐,𝑙)

subject to the budget constraint of

𝑐 = h𝑤 + 𝑌

where c represents the consumption of the worker and the right-hand side represents the income and non-labor income the worker will intake.

For simplicity, we will be considering Cobb-Douglas utility functions to compare different consumption and leisure preferences among the workers in our market. To show how we will calculate the reservation wage, we can start with a utility function that is indifferent to consumption and leisure and values them equally.

𝑈(𝑐,𝑙) = 𝑐𝑙

With this given utility function, we can derive the Marginal Rate of Substitution (MRS)

MRS = 𝑐/𝑙

The worker’s reservation wage is shown by the value of MRS when c = Y and l = H because this is the bundle that will represent when h = 0, or when the worker will choose to work 0 hours. Therefore:

w^r = MRS = Y/H

Now for the fun part. We know that each player has 4 years of eligibility that they can choose to play in college basketball or commit to playing professional basketball either in America or overseas, so H = 4. The tricky part is the non-labor income. It is well-known that collegiate basketball players in the National Collegiate Athletic Association(NCAA) are unable to profit off their name, image, and likeness, are unable to sign individual brand deals or make any income related to their position as an amateur athlete. Therefore, in this model, we will treat the athletes’ non-labor income as the expected earnings in their first year in the NBA. Considering the athlete that would become a marginal NBA player, the minimum salary for rookies was $898,310 for the 2020-2021 season. Therefore,

w^r = $898,310/4 = $224,577.50

Interpretation

What this number (about $225k) represents is the minimum amount of earnings that would induce participation in the labor market from the worker. Essentially, our model tells us that if a collegiate athlete with 4 years of eligibility is expecting to make the minimum NBA salary, he would be willing to work for any wage of at least $225k. Another way of thinking about this is how much are you willing to work for right now that would be equivalent to the non-labor income you know you already make.

Now, this example is only for a player that values his consumption and leisure equally to each other. For athletes that might prefer consumption higher, we can consider the utility function:

𝑈(𝑐,𝑙) =𝑐^2*𝑙

The above utility function is one in which the worker values his consumption twice as much as his leisure. In our labor market problem of basketball players, this would be a player that would value his income at the current time twice as much as the player shown in the original example. So, while the first player might have accepted a contract for $225k, this player would accept a deal for $112k, as he earns twice as much utility from his current wage. Lastly, let us consider a player that prefers leisure higher:

𝑈(𝑐,𝑙) =𝑐*𝑙^2

The above utility function is one in which the worker values his leisure twice as much as his consumption. In our labor market problem, this would be a player that valued his time in college twice as much as the player from the original example and would require a contract of $450k in order to give up his collegiate eligibility.

Results

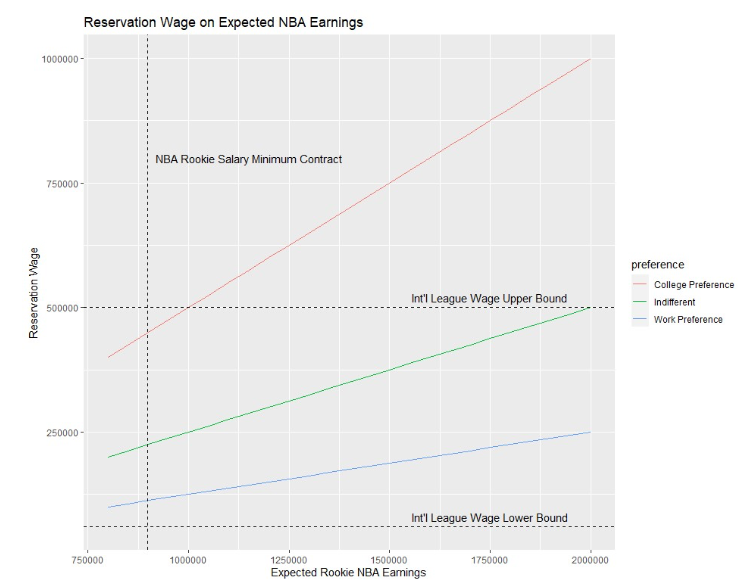

It should be noted that not all players are expecting exactly the NBA rookie minimum. The above chart shows a range of potential expected salaries for NBA hopefuls and the corresponding reservation wages for the three utility functions we have discussed compared to the range of potential salaries offered by the international basketball market.

Survival Model

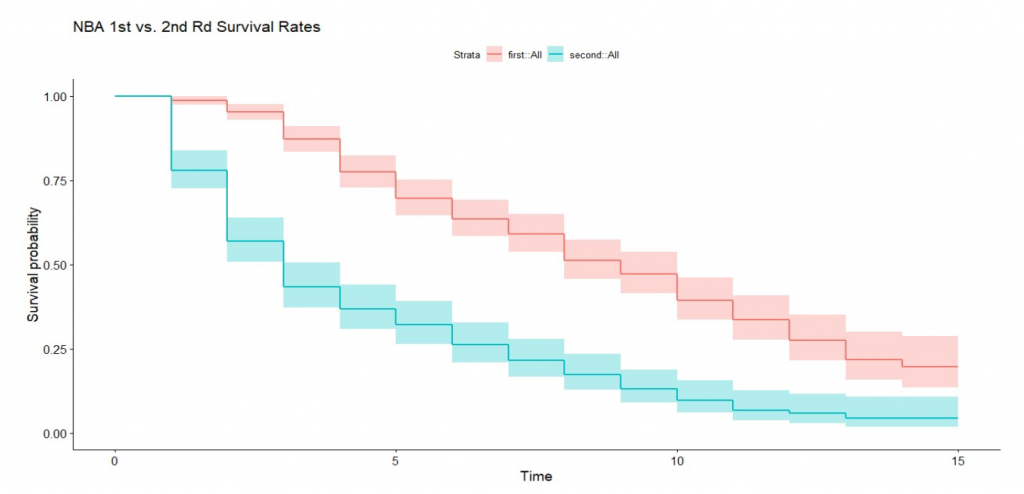

The above survival model shows the rates at which drafted players survived in the NBA. This specific data represents every player drafted from 2006 to 2015 and shows the average length of career in the NBA. For players drafted in the first round, the average career length was 9 years. This showed that not only are first round picks usually successful players, but they are also given many opportunities to succeed in the league before their careers are over.

Second round picks on the other hand, are rarely given extended opportunities to exceed in the league and usually only have a handful of opportunities to prove their worth before the league deems them unworthy of an NBA contract. The median career length for second round draftees was only 3 years.

This model exemplifies how ruthless the NBA labor market is. For a marginal player unsure of their professional basketball future, desiring an NBA contract isn’t always the safest plan. This leads us to explore international basketball markets

Concluding Discussions

It should be noted from the visualization that for any athlete that expects to earn a wage of $2m or less in the NBA and prefers work at least equally to time in college, it is more optimal for him to find employment in the overseas basketball market. This leads us to one of two conclusions.

One: There is an even distribution of players that value work more than college, college more than work, and those that are indifferent. Since we know that there are almost zero collegiate basketball players that give up their college eligibility to play overseas, this would suggest that those who remain in school are not acting efficiently. This would actually be supported by the new crop of elite NBA-hopefuls that are choosing to be employed by a G League team (specifically the G League Ignite) instead of spending one year playing college basketball. The athletes who choose this route are indicating high preferences towards their immediate work income over their college time and future earnings.

Two: That the athletes in the market are in fact acting efficiently, and the market is filled with players that have a heavy preference for their college years over immediate earnings and a subsequent loss of collegiate eligibility. The idea that four-year college players grow tremendously over their time in school and increase their future expected earnings with each year would support this conclusion.